How to Rob a Bank – Legally!

Image sourced by Etienne Martin@etiennemartin

Welcome Back!

This week, we bring you something delicious – a time-tested way to rob a bank, legally. Hands down!

Now finally, we have our chance to take money from a bank, not get in trouble and spend the money however we want, No questions asked!

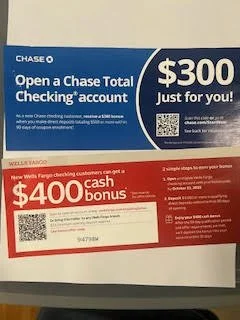

The other day, I received an envelope full of coupons from Valpak®. Which I’m glad to report, showed us exactly how to take money out of the bank’s pockets and put the money into our pockets! Boom!

This is exactly the type of deal that we love to bring to our Budget and Grow Rich® fans and friends.

The deal goes like this:

Banks seeking new customers offer cash bonuses to new customers who open a new checking account.

Here’s how!

When I was a kid, Chase Manhattan Bank gave me a ‘free’ basketball for opening a Certificate of Deposit (CD). [I refuse to reveal when that was. . . ☺ ].

While you should confirm the legitimacy of any offer directly with the bank – ‘look before you leap’ – I have found that these offers are typically legit.

In addition to Valpak®, your local US Post Office might offer a ‘New Resident Kit’ that contains attractive offers and discounts from various vendors. The vendors are looking to attract new customers so they offer discounts and promotions. Often there are offers from banks.

Last week, the Valpak® envelope contained two coupons where the bank would pay you, legally:

$400 cash bonus from Wells Fargo; and

$300 cash bonus from Chase Bank.

Okay, but what’s the catch?

◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊

Looking to build outrageous wealth and live your dream life?

The Secret is to create your personal spending plan. To multiply your wealth!

Click here!

◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊<§>◊◊◊

With both of these promotions, you have to be a New customer to the bank.

Both banks require you to open a New checking account with them.

Each coupon says, an “eligible Wells Fargo checking account” and a “Chase Total Checking®” account. There are several other criteria too.

You have to have a Tax Identification Number (or TIN), for example a Social Security Number (SSN).

The primary requirement is you have to make a certain amount of direct deposits within 90 days of enrollment (opening the new checking account).

In general, you have to make direct deposits from payroll (salary) or government pension benefits (for example, Social Security).

Direct deposit means your employer or pension fund sends the money directly to your bank (checking account); in other words, your employer does not give you a paper check and therefore you don’t deposit a check. Your salary or pension payment lands directly in your checking account, typically on payday or the night before. EASY.

The payments have to come via ACH, which means ‘Automated Clearing House’.

According to Investopedia, “The Automated Clearing House (ACH) is an electronic funds-transfer system that facilitates payments in the U.S. and internationally.”

In addition to ACH, there are several other payment vehicles that qualify.

Most employers process their payroll via a payroll processing company. Two of the larger payroll services companies are ADP (Automated Data Processing) and Paychex®. You may be familiar with them already.

Through these payroll services or a similar company, your employer may offer direct deposit payroll service that should meet both banks’ requirements. But be sure to confirm.

Both banks require you to direct deposit a minimum amount of money within the first 90 days of opening your account (described below).

But remember, the direct deposits are in after-tax dollars: your pretax salary minus your income taxes and other withholdings!

To estimate your total take-home pay for the 90 days, calculate your monthly take-home pay and multiply your monthly take-home pay by three since there are 30 days in a month, more or less.

See whether your take-home pay is greater than the bank’s required minimum.

If you want to capture both cash bonuses, you could split your paycheck in two so you can meet both banks’ direct deposit requirements.

Or if you already have a checking account, you could open a second checking account and activate direct deposit payroll so you direct deposit enough money (funds) with each bank. Again, you may have to split your salary (direct deposits) in two to qualify for the cash bonus.

Although, maintaining two checking accounts could add more administration to your life.

Remember that offers and promotions expire and change over time. So be sure to obtain a current promotion that’s still in force.

And move fast so you won’t miss out.

BUT to receive the cash bonus, you have to Want to open a new checking account.

Opening a new checking account may be easier said than done, especially if you already have a checking account, currently receive direct deposits and in addition have a lot of automatic payments. I have a bunch of inbound automatic payments and outbound automatic payments; so moving my checking account to a new bank would be a heavy lift.

Also, be sure you understand the bank’s schedule of fees and charges. But typically in my experience, with qualifying direct deposit payments, the bank waives the monthly checking account fees.

When you choose a bank, make sure there are ATM machines in the areas where you tend to make cash withdrawals. Even with the decline of cash and the increase in electronic payments, for example, Venmo®, PayPal and Zelle®, many people still use at least some cash. If you withdraw cash from an ATM that’s managed by a bank or a company other than your own bank, you’ll probably get hit with a lot of ATM cash withdrawal fees.

A few years ago, my colleague Matt was going to a golf outing and had left his wallet at home [a likely story. . .]. He asked me to lend him $200 in cash to cover his share of the costs.

Conveniently, there was an ATM machine in our office building.

The company managing the ATM machine charged me a $3.50 cash withdrawal fee. In addition. . .

My bank Wells Fargo charged me a $4.00 cash withdrawal fee. Because I made the withdrawal from an ATM run by a different company or bank.

$7.50 in extra fees in total. Ouch!

Matt repaid the $200 the next day.

Income Taxes. While you’re running calculations to evaluate whether this deal is right for you, contact your tax accountant, CPA or financial advisor to find out whether your cash bonus will be taxable income to you. Or ask the bank.

If you expect the cash bonus to be taxable, be sure to set aside money – budget – for the income taxes when they come due.

Income taxes could run 35% to 40% of the amount of the cash bonus.

If a deal like this interests you, be on the lookout for the Valpak® mailer and envelopes in your mailbox. Or visit the Post Office and get a ‘new resident kit’. And dive in.

But of course, make sure you read the fine print. Remember, each promotion is different. And there are specific requirements to ensure that you are eligible to benefit from the promotion and capture the cash bonus.

Call the bank, click the QR code printed on the coupon or visit the bank branch to see if you qualify and whether this deal is right for you!

Chase customer service: 1-800-935-9935

Wells Fargo customer service: 1-800-869-3557

Me?

I already have a checking account at Wells Fargo and one at Chase so I don’t qualify for either cash bonus. Oh well.

As my Grandpa Max used to say, “A day late and a dollar short.” Sometimes, you win some, sometimes you lose some. But. . .

Hopefully You can benefit from the Cash Bonus and laugh all the way to the bank.

Arthur VanDam

P.S. To Save More Money Every Day – click here.

Budget and Grow Rich® – ISSN: 2992-9296 – USA International Standard Serial Number

Disclaimer: OH and Please Remember, we are Not financial advisors, financial planners, attorneys or accountants and are Not providing any specific financial, tax, accounting or legal advice here. Be sure to conduct your own due diligence and consult your own professional advisors to get sound professional advice that’s specific to your financial and personal circumstances, risk tolerance, time horizon and investment goals and objectives among other key factors!

Take your Business, Career & Life to a New Level with this Experiential, Immersive Live Event FREE!

How to Make Money in your Spare Time Writing Letters.

How to Succeed and Achieve Your Dreams!

Tired of the rat race?

To Succeed even bigger, greater and stronger, 10X your success – click here.